Description

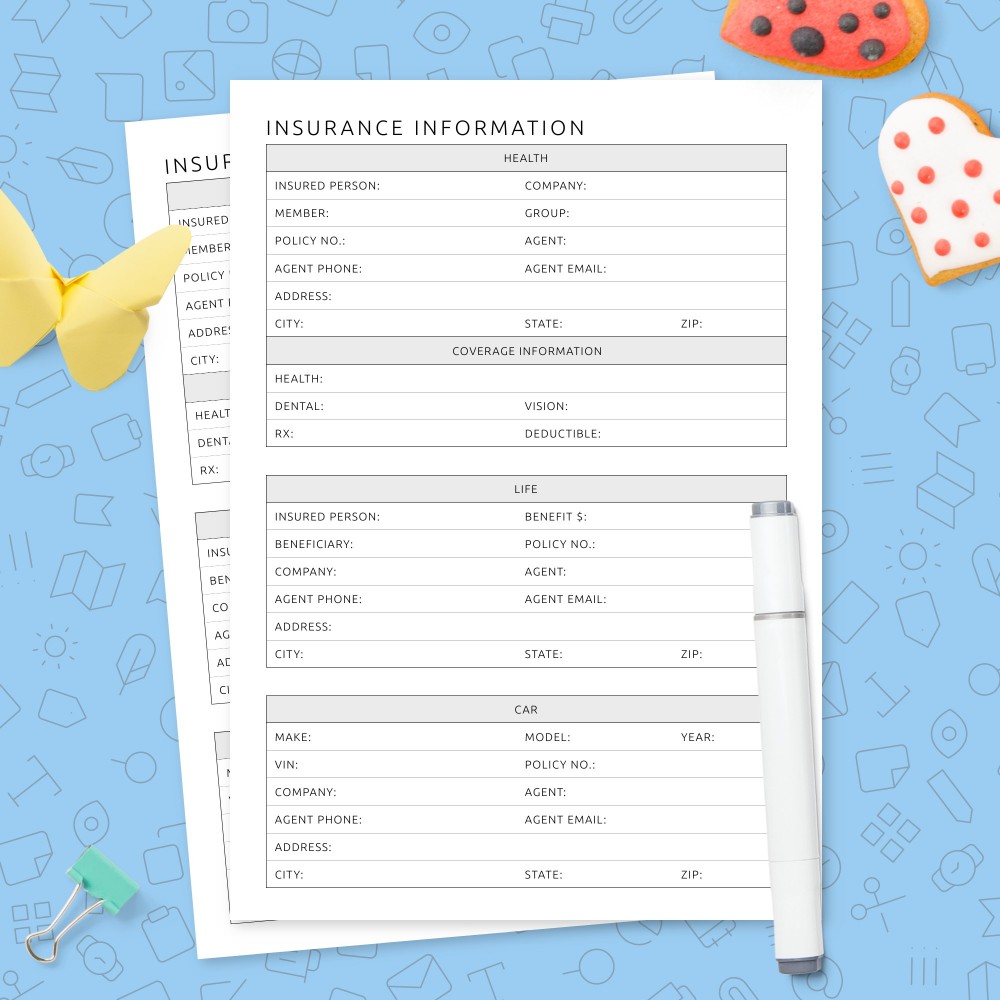

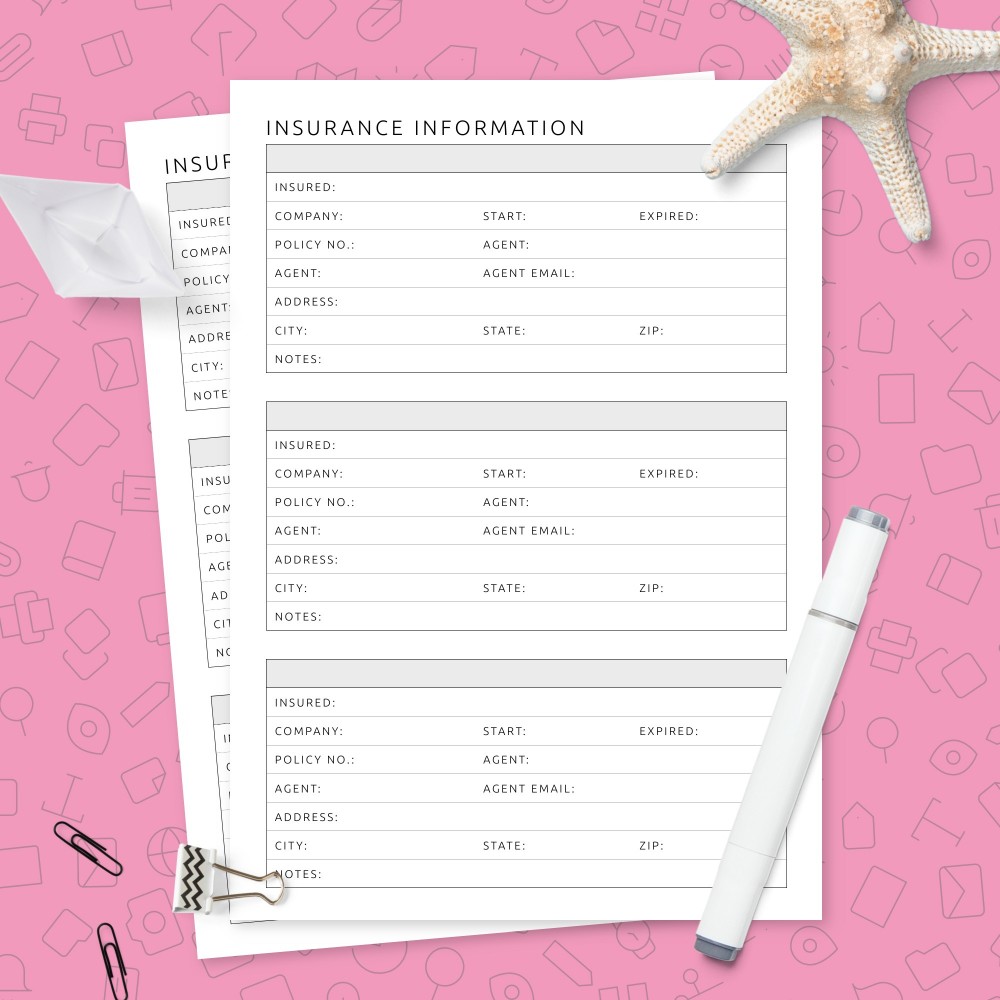

The Insurance Information Extended Template is a meticulously designed and comprehensive resource to empower individuals and families in managing their insurance portfolios. In a world where uncertainties abound, this extended template goes beyond the basics to provide an in-depth and organized approach to documenting crucial insurance details. With sections covering policy specifics, claims history, beneficiaries, and more, this template serves as a one-stop solution for those seeking a thorough understanding of their insurance coverage.

Section 1: Personal Information:

- The template begins by capturing essential personal details, including the policyholder’s name, contact information, and identification particulars.

- This section ensures that the document is personalized and can be easily identified, providing clarity in communication with insurance providers.

Section 2: Policy Overview:

- A clear and organized overview of each insurance policy, including policy names, numbers, and effective dates.

- This section acts as a quick reference guide, offering a snapshot of the various insurance policies held by the individual or family.

Section 3: Policy Details:

- A comprehensive breakdown of each policy’s specifics, encompassing coverage types, limits, deductibles, and exclusions.

- In-depth information empowers individuals to understand the nuances of their coverage, fostering informed decision-making.

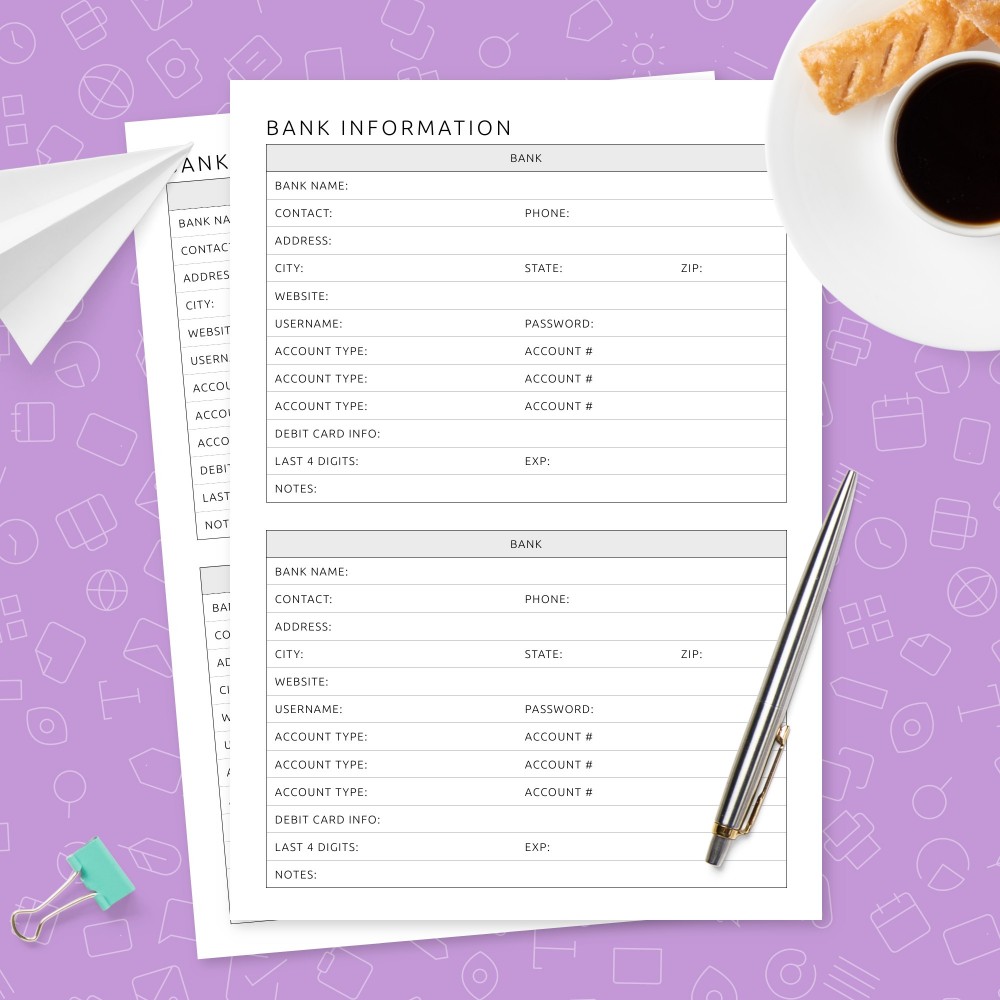

Section 4: Premiums and Payment Details:

- A dedicated space to document premium amounts, payment schedules, preferred payment methods, and potential discounts.

- This section aids in financial planning by providing a clear picture of ongoing and upcoming insurance-related expenses.

Section 5: Contact Information:

- Essential contact details for insurance providers, including customer service numbers, agent information, and emergency contacts.

- This ensures prompt communication and assistance when needed, fostering a strong and efficient relationship with insurance providers.

Section 6: Policy Documents and Endorsements:

- An area to note where physical or digital copies of policy documents, endorsements, riders, and related paperwork are stored.

- Keeping track of these documents ensures accessibility during claims processing, policy reviews, or updates.

Section 7: Beneficiaries and Trust Information:

- A space to record details about policy beneficiaries, trust information, and any relevant estate planning details.

- This section ensures that the intended recipients of the policy benefits are documented.

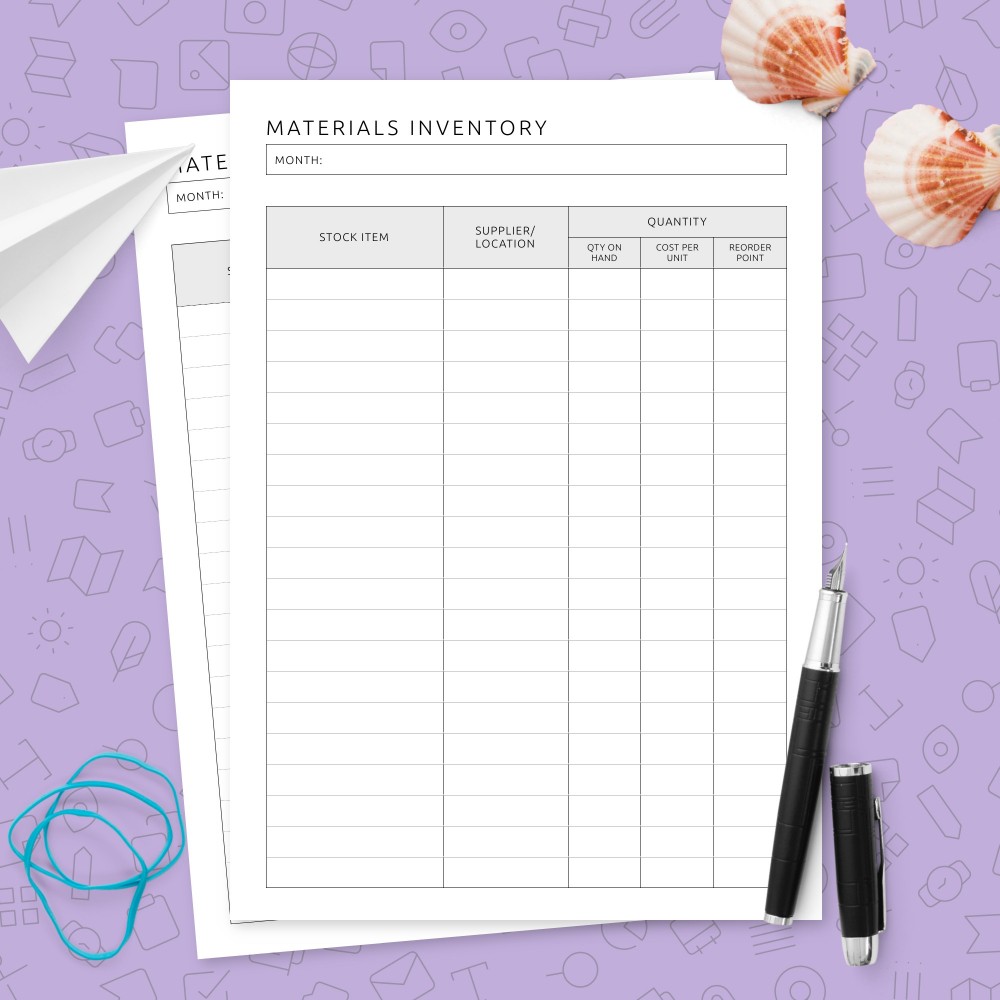

Section 8: Claims History:

- A log to record past claims, including dates, nature of the claim, amounts involved, and outcomes.

- Maintaining a comprehensive claims history aids in assessing the impact on future premiums and overall insurance strategy.

Section 9: Policy Reviews and Updates:

- A structured area to plan and document regular policy reviews, updates, and potential policy changes.

- This section promotes proactive management of insurance coverage to align with evolving needs and circumstances.

Benefits of the Insurance Information Extended Template:

- Comprehensive Documentation: The extended template provides a comprehensive overview of insurance details, covering various aspects of policy management.

- In-Depth Understanding: Detailed breakdowns of policy specifics enable policyholders to have a nuanced understanding of their coverage, facilitating informed decision-making.

- Efficient Communication: Quick access to contact details ensures efficient communication with insurance providers, especially during emergencies or inquiries.

- Holistic Financial Planning: The inclusion of premium details and payment schedules contributes to holistic financial planning, aiding individuals in budgeting for insurance expenses.

- Proactive Policy Management: Sections like policy reviews and updates encourage proactive management of insurance portfolios, ensuring that coverage aligns with changing needs.

Conclusion:

The Insurance Information Extended Template goes beyond the standard documentation, providing individuals and families with a comprehensive resource for managing their insurance portfolios. With a focus on thorough documentation, understanding coverage nuances, and fostering efficient communication, this extended template acts as a robust tool for those seeking financial security and peace of mind. By addressing various facets of insurance management, it empowers individuals to navigate uncertainties with confidence and strategic planning.

Hauwa –

The Insurance Information Extended Template is a time-saving gem. No more digging through piles of papers or searching through emails for policy details. Everything is securely stored in one place, streamlining the process and giving me confidence in the security of my insurance information.

Yahaya –

Managing insurance information has never been easier. The Extended Template simplifies the record-keeping process, offering a structured layout for all policies. It’s efficient, and the extended details section is particularly helpful for including additional notes or specific coverage details. A valuable tool for staying on top of insurance matters.

Isah –

This template provides peace of mind by organizing all my insurance information in a clear and concise manner. It covers the essentials and more, ensuring that I have quick access to critical details in case of emergencies. It’s a reliable and efficient organizer for anyone managing multiple insurance policies.

Mercy –

The Insurance Information Extended Template is a lifesaver for keeping all my insurance details in one place. Its comprehensive layout covers every aspect, and the user-friendly design makes it easy to input and update information. A must-have for anyone looking to stay organized with their insurance records.