Description

The Insurance Information Template serves as a cornerstone for individuals and families seeking a comprehensive and organized approach to managing their insurance details. In a world where uncertainties are inevitable, having a structured record of your insurance information is essential for financial security, peace of mind, and efficient communication in times of need. This template is meticulously designed to provide an accessible and user-friendly resource for documenting crucial insurance details across various policies.

Section 1: Personal Information:

- The template begins with a section for personal information, including the policyholder’s name, contact details, and identification information.

- Capturing the insured party’s details ensures clarity and quick identification when communicating with insurance providers.

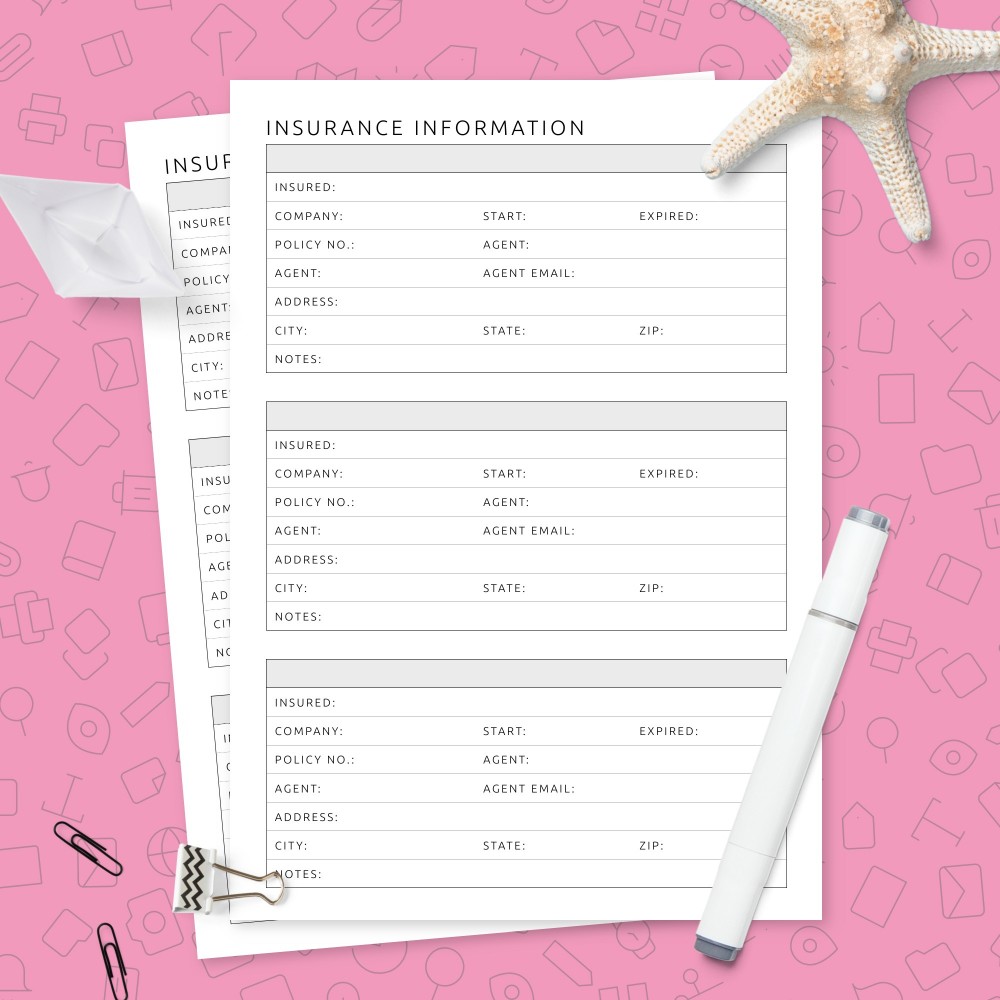

Section 2: Policy Overview:

- An organized layout to record an overview of each insurance policy, encompassing policy names, numbers, and effective dates.

- This section acts as a quick reference point, offering a snapshot of your insurance portfolio.

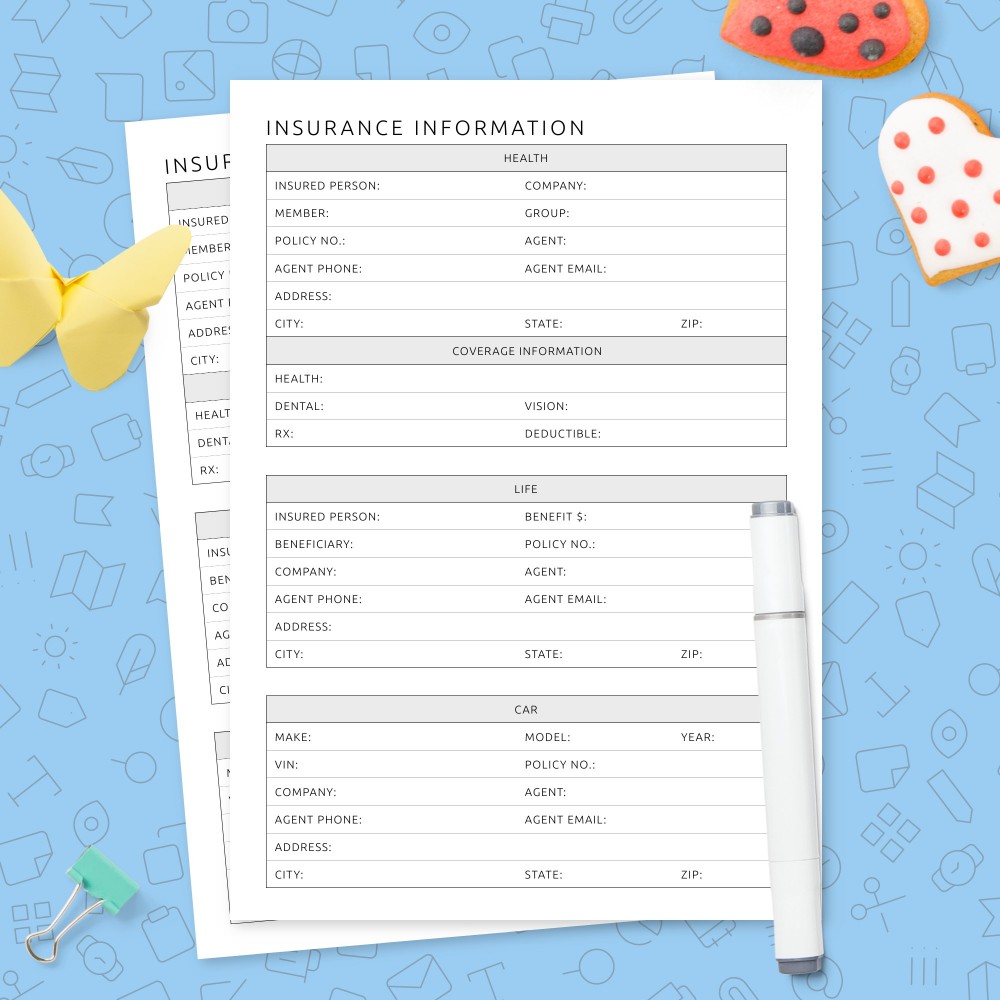

Section 3: Policy Details:

- A comprehensive breakdown of each policy’s specifics, such as coverage types, limits, and deductibles.

- In-depth information aids in understanding the scope and limitations of each policy, facilitating informed decision-making.

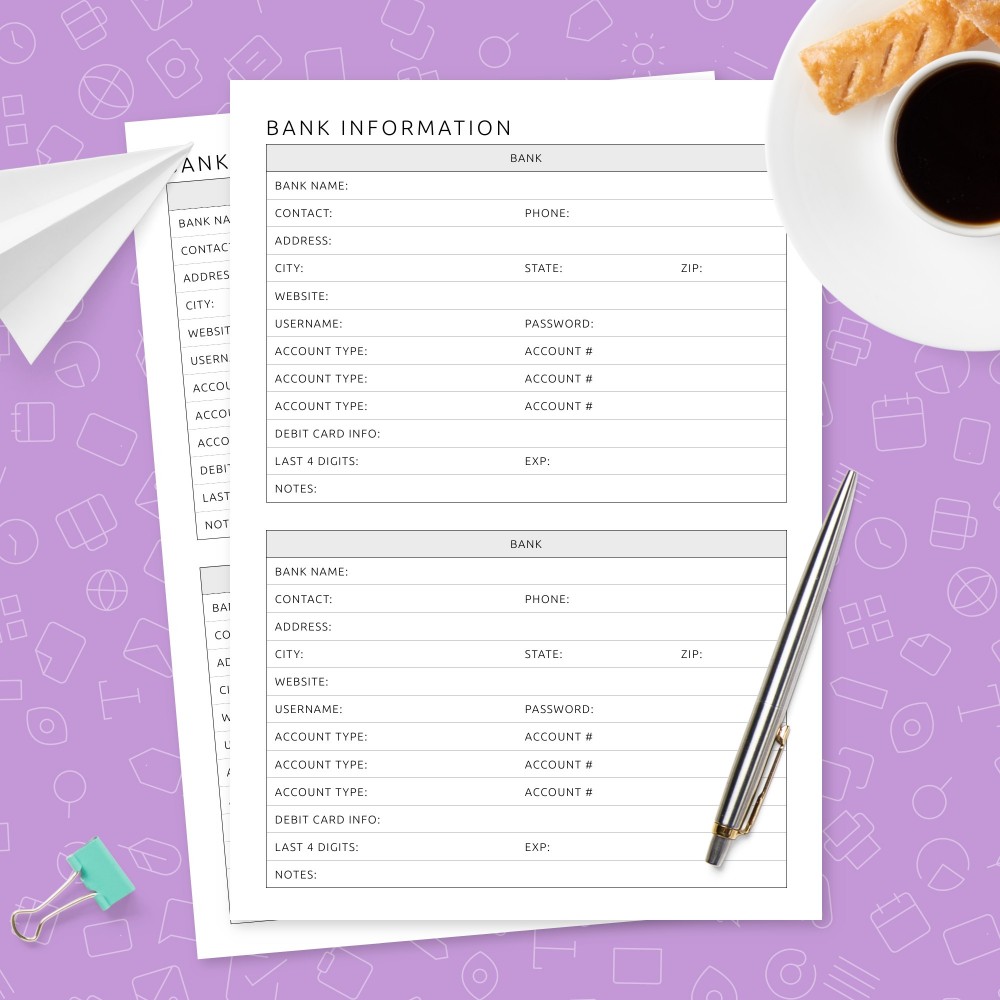

Section 4: Premiums and Payment Details:

- A dedicated space to document premium amounts, due dates, and preferred payment methods.

- This section streamlines financial planning by providing a clear picture of ongoing and upcoming insurance-related expenses.

Section 5: Contact Information:

- Essential contact details for insurance providers, including customer service numbers, agent information, and emergency contacts.

- This ensures prompt communication and assistance when needed, fostering a seamless relationship with insurance providers.

Section 6: Policy Documents and Endorsements:

- An area to note where physical or digital copies of policy documents, endorsements, and riders are stored.

- Keeping track of these documents ensures accessibility during claims processing or policy reviews.

Section 7: Claims History:

- A log to record past claims, including dates, the nature of the claim, and outcomes.

- Maintaining a claims history aids in assessing the impact on future premiums and overall insurance strategy.

Benefits of the Insurance Information Template:

- Centralized Information: The template consolidates diverse insurance details into a single, accessible document, eliminating the need for scattered records.

- Quick Reference: The organized layout allows for quick reference to crucial information, saving time during emergencies or policy reviews.

- Informed Decision-Making: Detailed policy breakdowns empower policyholders to make informed decisions about coverage and understand the financial implications.

- Efficient Communication: Having contact details readily available streamlines communication with insurance providers, ensuring swift and effective assistance.

- Financial Planning: Recording premium amounts and due dates aids in financial planning, helping individuals budget for insurance expenses.

Conclusion:

The Insurance Information Template is a valuable tool for individuals and families navigating the complexities of insurance coverage. By centralizing essential details, promoting informed decision-making, and fostering efficient communication, this template contributes to a proactive and empowered approach to managing insurance portfolios. As a comprehensive guide to your coverage, it acts as a reliable resource in times of uncertainty, providing the foundation for financial security and peace of mind.

Daniel –

This template is incredibly efficient and effective. It covers all the essential details without overwhelming the user. I appreciate how it helps me stay organized and ensures that I have important insurance information at my fingertips when needed. A practical tool for anyone looking to manage their policies effortlessly.

David –

The Insurance Information Template has simplified the often complex world of insurance management. Its straightforward design allows for quick and easy input of policy details. It’s a streamlined solution for keeping all insurance information in one accessible place.